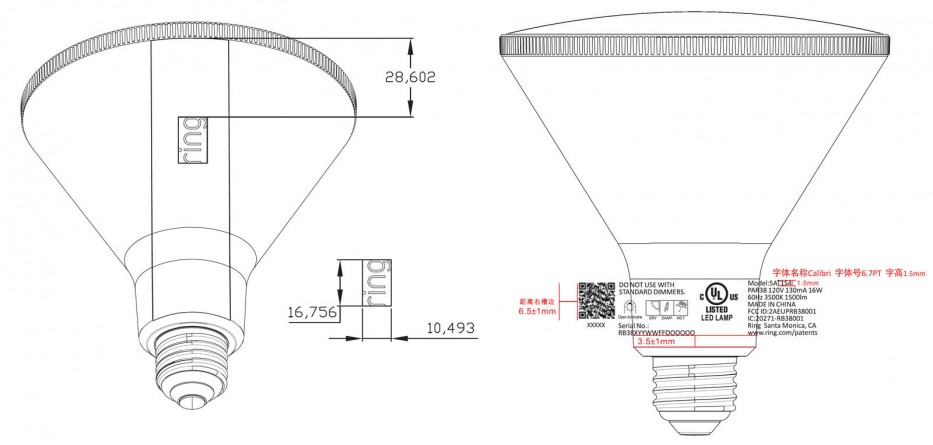

Amazon-owned Ring tendered a “Ring Smart Lightbulb” filing to the FCC, a sign that the company may be looking to further push its smart home lineup.

For Ring — whose products include security systems, video doorbells, security cameras, and smart lighting products — this would characterize the company’s first venture into standalone smart lights (supposing that is the intended application). A smart floodlight would supplement Ring’s current security-centric lineup, as it could fasten into existing light sockets, and turn on and off in pair with security camera feeds.

By possibly moving into the smart lighting space, Amazon would further compete smart home partners by influencing valuable market share. Amazon initiated the $100-million-dollar Alexa Fund in 2015 to train third-party smart home device manufacturers for the Alexa smart home platform. This was symbolic of its strategy in the early days of the smart home industry when ecosystem suppliers — most notably Google and Amazon— invited third-party developers to make extensive product lineups.

While Alexa still interacts with devices from numerous third-party partners, the company has slowly extended its own product lineup, often opposing the company directly against those partners. Beyond the expanding Ring lineup, Amazon also presented connected microwaves, plugs and ovens. As smaller smart home players are dependent on Google’s and Amazon’s ecosystems, they have little option when the tech giants jeopardize their market share by introducing in-house alternatives. The acquisition may signify an attractive departure for smaller players in the space, as was the case for  Ring, Nest, and, most lately, Eero, which Amazon bought at a sheer discount.

Amazon has numerous advantages over third-party partners that enable it to present a latecomer challenge to multi-billion dollar businesses. When Amazon decides to enter a new smart home product segment, it is not arriving on equal terms with third-party partners.

One apparent advantage: Amazon runs the world’s largest e-commerce channel and has historically attuned product-search algorithms to prefer its own products against those of competitors, as reported by The Wall Street Journal. Moreover, increased inquiry on IoT device security could take consumers to established, wide-in-scope brands such as Amazon, instead of smaller competitors. Considering these factors, Amazon can practically expect to succeed as a late participant to high-growth smart home segments. Smart lights, for example, are expected to increase from 144 million units in 2019, to 541 million units by 2024, according to Business Insider Intelligence estimates.Â

Amazon has continued to walk toward smart home device dominance, regardless of increased regulatory inspection. Politicians in both the European Union and the US are examining whether Amazon has misused its dominant market position to hurt competitors. The development of Ring’s lineup at this time could possibly increase scrutiny in these market conditions, as it may further merge the smart home segment around Amazon.Â

Â